FAQ

To proceed to the PIP FAQ, you MUST have read the Characteristics and Risks of Options Disclosure Document. If you have NOT read this document, click on the “No” button and you will be directed to read this document online, or you may call PTI at 800.821.4968 to request a hard copy.

Does my money stay in my account?

How do you decide what indexes to buy?

What degree of protection will my account have and who decides what put-strikes to buy?

What are the management fees?

Who will manage my account?

Will I be able to keep track of my own account?

What is the minimum amount to open a PIP account?

Can the PIP be used in my IRA?

What amount of total risk is typical in a PIP account?

What type of account protection is in place for PTI account holders?

How do I get started? Who do I need to talk to?

Does my money stay in my account?

As a PTI Securities & Futures client, yes, the money remains in your account.

Back to top

How do you decide what indexes to buy?

After consultation with the client, a mutual decision will be reached to determine which indexes to buy.

Back to top

What degree of protection will my account have and who decides what put-strikes to buy?

After consultation with the client, a decision will be reached to determine the degree of protection desired as well as the appropriate put strike to buy.

Back to top

What are the management fees?

There are no management fees or inactivity fees for accounts held at PTI Securities & Futures, just the standard broker-assisted trading commission fees apply. See commission rates below.

Back to top

Who will manage my account?

Either Tom Haugh or Dan Haugh will be managing your account.

Back to top

Will I be able to keep track of my own account?

Yes, you will be able to access your account online through PTI’s ActiveTrader system.

Back to top

What is the minimum amount to open a PIP account?

The suggested account minimum is $75,000.

Back to top

Can the PIP be used in my IRA?

As long as you have an IRA account that allows protected puts and covered calls. IRA accounts at PTI Securities & Futures (utilizing the Delaware Charter Agreement) may elect to utilize this management program.

Back to top

What amount of total risk is typical in a PIP account?

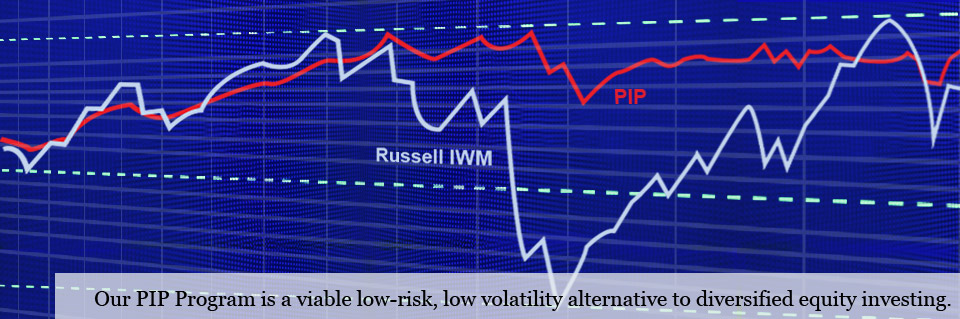

The amount of initial risk (customized to the needs of the individual client) is typically in the 8-12% range.

Back to top

What type of account protection is in place for PTI account holders?

Member of SIPC, which protects securities customers of its members up to $500,000 (including $100,000 for claims for cash). Explanatory brochure available upon request at www.sipc.org. Additionally, together with RBC Capital Markets, PTI has purchased excess SIPC coverage to insure each account for an additional $29.5 million in securities. Note: SIPC does not cover commodity contract and options on futures. SIPC does not protect against market loss.

Back to top

How do I get started? Who do I need to talk to?

E-mail or call Dan Haugh toll free at 800.821.4968 to discuss your risk profile and investment goals, then click open account.

Back to top