Portfolio Construction

To proceed to the Portfolio Construction webpage, you MUST have read the Characteristics and Risks of Options Disclosure Document. If you have NOT read this document, click on the “No” button and you will be directed to read this document online, or you may call PTI at 800.821.4968 to request a hard copy.

How can we limit the risk of major downside moves? The development of longer-term options, called LEAPS, has reduced the day-to-day cost of protection due to the unique way options decline in value over time. Options do not decay linearly, meaning that in most situations (can be different in periods of extreme market volatility) the further out in time an option expiration date goes the lower its protective cost on a daily basis. Prior to their development, the insurance costs in terms of dollars per day for using traditional short-term options was too excessive for continual use. The non-linear dollar decay curve of long-term options allows the dollars per day insurance costs to be acceptable for long-term use. PTI firmly believes that the only way for an investor portfolio to achieve a level of protection against extreme downside market moves is through the purchase of put options. The purchase of Exchange traded put options lowers the risk of downside market moves to the amount of the premium paid for the put plus the amount the put is out of the money (if any). Trusting an advisor or manager to spot the bumps in the road or general overvaluation and act in time was always expecting too much, as recent events have clearly shown.

The purchase of the LEAP put, although significantly reducing the risk of the position, does not eliminate the initial total risk of the position. Initially, the risk of the position is the amount paid for the put plus the amount that the put is out of the money. Therefore, an additional part of the PTI strategy is the sale of near-term out-of-the-money covered call options as a way to pay for the cost of the long-term put insurance. Out-of-the-money call options are options written above the current price of the underlying security. For example, if the underlying security was trading $100, a sale of a call above $100, say the $105 calls, would be considered out-of-the-money. The same non-linear way that long-term options decline in value relatively slowly causes near-term options to decay rapidly. In fact, it is often possible and is our goal to pay for the insurance cost long before the insurance expires.

How is this strategy going to work, both short and long-term?

On a long term basis, the total risk of a sample initial position would be as follows:

Purchase of sample ETF cost per share ………..$101.00 Purchase of 2-3 year 100 put on that ETF……… $ 11.00 Sale of a one month 105 call on that ETF………..$ (1.00) Total cost per share ………………………………….$111.00

The long term put establishes a minimum value of the position of $100 because of the put which is the right to sell the stock at $100 for the life of the put. Therefore the maximum risk of the position is established to be $11.00 per share. This is $11 of risk for an investment of $111 or 9.9%. This risk will vary by the option prices at the time of investment, but can be established prior to the investment based on the option prices at that time. For each successive month, another call can be sold, but no other put need be purchased for the life of the put so each month additional call sales can lower the total cost and therefore the risk of the position. Future call sales can never be accurately predicted, however we do expect to significantly reduce or hopefully totally offset the cost of the put.

On a short-term basis it should perform as follows:

The strategy may under perform the averages (maybe significantly) in any month where prices appreciate more than the percentage out of the money of the calls sold. In fact, the upside is limited to the amount of the premium in the call sold plus the amount the call was out-of-the-money. For example, if the underlying was trading $100 and the $105 call was sold for $2, the maximum upside potential would be the $2 premium plus the $5 amount out-of-the-money ($105-100) for a total of $7.

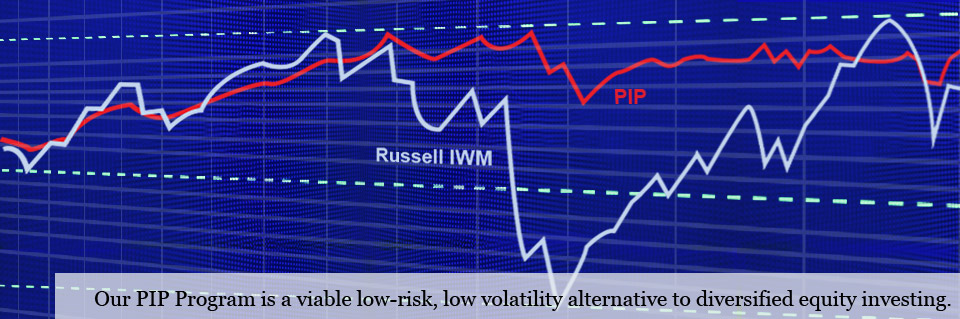

The strategy may significantly out perform the underlying index in rapidly decreasing markets, due to both the put protection purchased and the call premium sold.

The strategy may tend to outperform the market in times of small market movements, as the time decay of the short call is generally greater than that of the long put (this relationship can be affected by general market volatility and by prices paid by the particular put purchased or calls sold).

Sample Portfolio Construction

The goal is to diversify the investment through the use of exchange traded unit investment trusts. Currently there is an ever increasing number of these products, but the most liquid are the SPY, containing the stocks of the S&P 500, and the IWM, containing the stocks of the Russell 2000. We are also watching the growth of the Select Sector SPDRs to allow us to over and under weight specific market sectors.

In addition to the diversification achieved by the ETF itself, we further that by using more than one ETF. Along with the purchase of the ETF shares, PTI selects through its proprietary timing model the optimum combination of long-term put insurance and shorter-term call sale. This model takes into account various factors, such as implied volatilities, interest rates, recent market moves, etc. In most cases the combination of the put and call will be selected to limit total risk on the initial investment. As the program advances this initial risk number will decrease as a percentage of the initial investment.

Long-term Objective

On a long-term basis we believe that this strategy will equal or exceed the long-term return of the market averages, with much less total risk to the portfolio and much less month to month volatility. As such we believe this to be a competitive core strategy for a wide range of individual and institutional investors.